全球经济状况调研:2016年第三季度

While Brexit has dominated economic and political headlines in Europe, the rest of the world is unperturbed. However, the manufacturing purchasing managers’ indices (PMIs) suggests that global growth remains weak.

The UK economy broadly appears to be weathering the initial fallout from Brexit has certainly helped, but other factors have also played a part. Better news from China has supported commodity prices, which in turn has lifted sentiment in other emerging markets.

Deep recessions are ending

Other big emerging markets are showing signs of improvement.

Deep recessions in Brazil and Russia are finally coming to an end, while easing inflation should open the door for interest rate cuts soon that should further boost growth. In India, there are encouraging signs that Prime Minister Modi is starting to make good on his reform agenda after the passage of a landmark bill on goods and services tax in August.

Government spending index

A rise in the government spending index was a key factor behind the improvement in global confidence in Q3 which is now at its highest level since the third quarter of 2014.

The capital expenditure index also picked up slightly – as did the new orders index.

Hiring flat lining

So far hiring has not picked up: 50% of respondents say their business is considering either a hiring freeze or staff cuts, compared with just 19% who say they are hiring more staff. In every region there were more businesses planning to cut staff than hire more.

According to data from the World Trade Organization (WTO), countries are applying record numbers of trade restrictions against other nations: its members applied an average of 22 measures each month between October 2015 and May this year – the highest number since 2011.

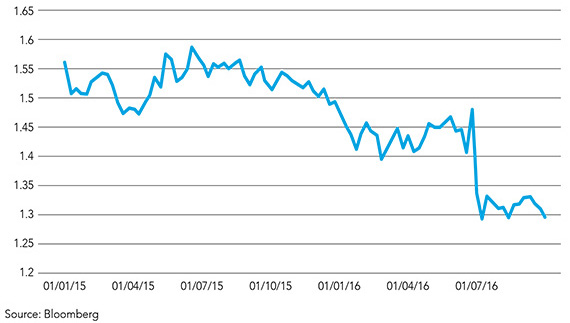

Graph showing the pound plummeting against the US dollar.

手机扫描二维码,关注ACCA中国官方微信。