全球经济状况调研:2016年第二季度

Improvement in global business confidence in Q2 was driven by non-OECD economies. Concerns about a near-term collapse in China’s growth subsided. By contrast, business confidence in OECD economies dipped again in Q2, and the UK’s referendum on leaving the EU was a key factor.

The pick-up in global confidence has not so far been matched by an improvement in the capital expenditure and employment indices, which have remained downbeat. Half of firms are still either cutting or freezing employment, while only 13% are increasing investment in staff.

Firms scale back capital projects

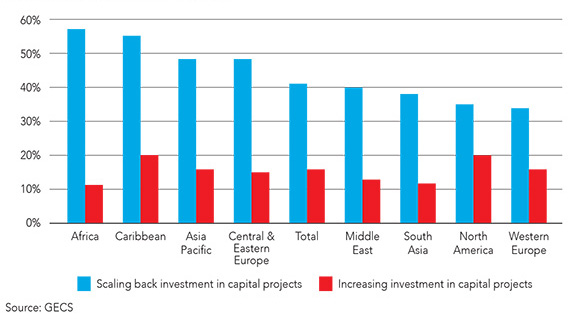

Only 16% of businesses reported that they are increasing investment in capital projects, compared with 41% that said they are reducing investment. In every region there are far more firms scaling back investment than increasing it, but the gap was smallest in the US and Western Europe.

Different investment intentions

There was also a notable difference between the investment intentions of SMEs, 38% of which said they are scaling back investment, compared with 43% reported by large firms. Large firms tend to rely more on overseas demand than SMEs, and are therefore likely to have been hit harder by the downturn in global trade.

Graph showing reluctance to invest by region. Africa is the region scaling back investment in capital projects the most.

Firms to explore cost cutting

Despite 39% of businesses saying that rising costs were a problem in Q2, 49% of firms said that they saw an opportunity to explore cutting costs. This is not surprising, after all, the latest recovery in commodity prices has still left them well below the highs of a couple of years ago, and the global inflationary environment remains very weak.

手机扫描二维码,关注ACCA中国官方微信。