综合报告中的重要性与简洁性

Corporate reports have grown in length and complexity, leading to calls for a more holistic approach to reporting the economic, environmental and social aspects of business. This is where integrated reporting comes in – but is materiality in this context well understood?

Materiality and conciseness matter to corporate report preparers, auditors and users of reports.

Decisions on materiality

Many companies have a specific process for identifying material matters and deciding what to disclose in their reports which involves consultation with external and internal stakeholders.

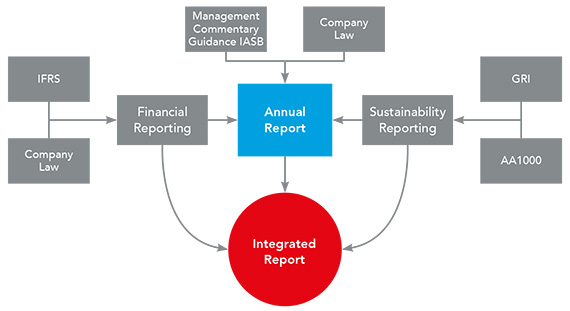

Statutory and voluntary reporting frameworks influence decisions about materiality.

Although the majority of companies seem pretty good at identifying and disclosing material items, few explain the processes they used to evaluate and prioritise material matters in their reports.

How do preparers achieve conciseness?

Many companies engage with both internal and external stakeholders to identify the topics that are most material to them.

Companies adopt a wide range of approaches to make their corporate reports as concise as possible.

Key approaches include:

· focusing on material items: this includes adopting general reporting principles such as transparency, consistency, completeness and accuracy

· being strict about content: both in terms of length and topics

· using presentation techniques: layout, interrelationship of sections, and cross-referencing within the report and to additional materials on their website

What is considered material?

Evidence from the behavioural experiment suggests that preparers and auditors are more likely to consider financial items to be material than social and environmental items. This is consistent with a conventional interpretation of value as a monetary concept.

Challenges

Some challenges to the wider adoption of integrated reporting include:

· Defining <IR>’s interaction with regulatory requirements – The direction of travel for <IR> will differ from jurisdiction to jurisdiction. The key questions are:

· How do integrated reports fit within the requirements for other reports and the concepts used in those reports?

· How can useful information in integrated reports be promoted within existing legal reporting frameworks?

· Dealing with business complexity and user expectations – Preparers are concerned about how they can provide a concise report that is not too broad to be useful and at the same time meets the needs of a range of stakeholders with one report.

· Winning the cost vs benefit argument: <IR> is a potentially expensive activity because of the resources involved and the degree of cultural change required. To encourage widespread adoption, clear benefits need to be demonstrated.

· Clarifying the roles of auditors and assurance providers: An assurance framework for <IR> is yet to emerge, but auditors, who are experienced with providing assurance on management commentary and sustainability reports, have a key role to play in:

· educating preparers about <IR> and

· shaping best practice in the design of internal controls around internal data collection systems.

Diagram showing frameworks influencing evolution of <IR>.

手机扫描二维码,关注ACCA中国官方微信。在对话框输入“MCIR”,即可将报告直接下载到您的手机。